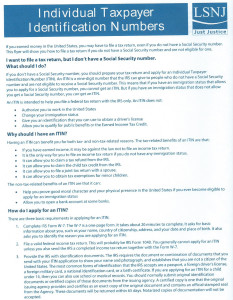

Many immigrants who work steadily in the U.S. do not have Social Security numbers. However, it may be against the law not to file an income tax return even though the government will not allow the person to have an SSN. Fortunately, it is possible to obtain an Individual Taxpayer Identification Number (ITIN).

Many people don’t want to pay taxes! However, there are several benefits of getting an ITIN and paying them: you can claim a tax refund from the IRS; you can claim the child tax credit and file a joint tax return with a spouse; and it allows you to obtain tax exemptions for minor children.

In addition, having a record of having paid taxes can be a major advantage if you ever become eligible to apply for an immigration status: it shows that you are of good moral character, and documents your physical presence in the U.S. Also it allow you to open a bank account at some banks.

For more information go to the web site of the Legal Services of New Jersey, www.lsnjlaw.org or call them at 1-888-576-5529. The IRS is not allowed to report you to Immigration if you have applied for an ITIN.

Hey I am so glad I found your blog page, I really found you by mistake, while I was

researching on Askjeeve for something else,

Nonetheless I am here now and would just like to say many thanks for

a incredible post and a all round exciting blog (I also love the theme/design),

I don’t have time to look over it all at the

minute but I have book-marked it and also added in your RSS feeds, so when I have time I will be back to read much more, Please

do keep up the excellent jo.